Fed’s Unprecedented Interest Rate Hike Means Uncertainty For US Banking Sector, A&M Prof Says

Federal Reserve officials released an interest rate decision Wednesday afternoon that a Texas A&M University finance expert says will likely send shockwaves throughout the financial markets and U.S. banking sector.

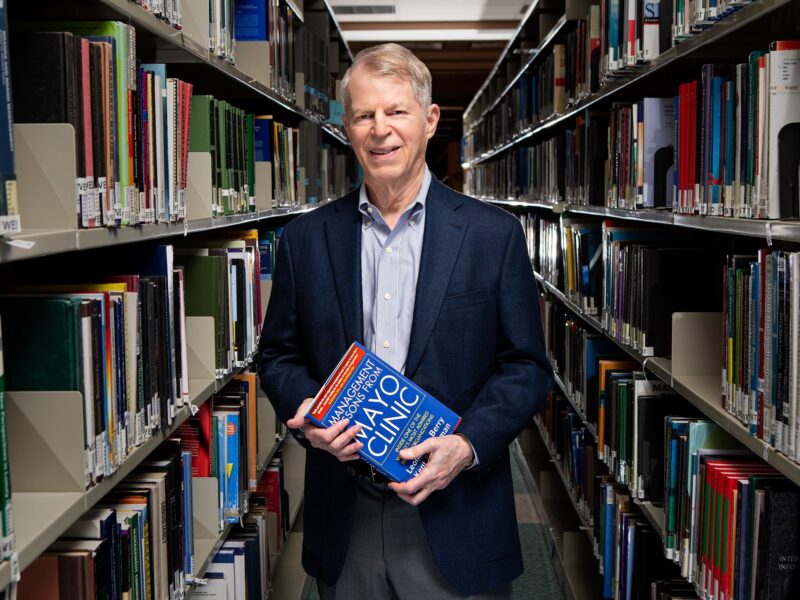

The country’s central bank announced it will raise interest rates by a quarter point in an effort to continue to curb inflation. Sorin M. Sorescu, a professor of finance and the Foreman R. and Ruby Bennett Chair in Business Administration at Mays Business School, explains the decision has resulted in interest rates skyrocketing by 4.75% since March 2022 — a rate of increase that has no precedent in recent history.

“Anything that pushes interest rates up in the next year, whether it’s the Fed or fear of defaulting on the national debt because of the debt ceiling, is going to endanger the fragility of the banking system,” Sorescu said. It could also cause more bank failures and bailouts, which could mean less credit available for Americans to buy things like houses or cars.

Sorescu’s research focuses on the effect of interest rates on banks. He said fixed-income investments, such as government bonds and long-maturity loans, have been hit hard by the rapid increase in interest rates and suffered significant losses in value. Banks are now grappling with the impact of these losses on their capital and overall financial health.

“Some banks are struggling to survive in an environment in which interest rates have increased so rapidly and unexpectedly, almost 5% in a year. No one expected that,” he said. “Many were caught with investments they made that lose value when interest rates go up, and the banks themselves go bankrupt.”

Sorescu said the collapse of Silicon Valley Bank and First Republic Bank serve as prime examples of the damage these losses can inflict on financial institutions. Both banks had large exposure to interest rate risk, causing significant unbooked losses on their investments. Depositors lost confidence in the banks’ stability and withdrew their funds, Sorescu said, ultimately causing their collapse.

“Among the large banks, the two banks that were in the biggest danger of failing have already failed to date,” he said. “There are probably between five and 10 banks that are next in line and could fail if interest rates continue to be high.”

A new study co-authored by Sorescu and Mark J. Flannery from the University of Florida reveals that Silicon Valley Bank and First Republic Bank are far from isolated cases. Their research details more than $1 trillion in unbooked losses throughout the U.S. banking sector.

If these losses were properly accounted for in bank capital, Sorescu explains, more than half of banks owning over 50% of the nation’s banking assets would be undercapitalized.

“It doesn’t take much for these paper losses to convert into real losses,” he said. “All it takes is for people to lose confidence and take their money out. If that were to happen, there’s just not enough money in the Federal Deposit Insurance Corporation (FDIC) Insurance Fund to pay for these banks to fail. Then you would be looking at taxpayer bailouts and potentially much more severe circumstances.”

The banking sector has experienced volatility on numerous occasions, with the most recent example being the 2008-09 Global Financial Crisis. But Sorescu said the current instability differs in its underlying causes.

In 2008 and 2009, bank losses were driven by loans of poor credit quality. In contrast, today’s losses stem from the loss of market value of investments that are otherwise considered safe from a credit perspective.

“As the banking sector continues to face these unprecedented challenges, it remains to be seen how financial institutions will adapt and weather this storm, and what measures regulators may take to address the situation,” he said.

Media contact: Michelle Blakley, Mays Business School, mblakley@mays.tamu.edu