New Study Examines Alternative Fuel Vehicles’ Impact

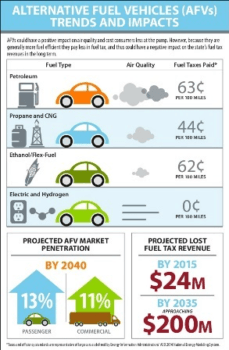

Alternative Fuel Technology adoption could affect long-term state fuel tax revenues with Alternative Fuel Vehicles (AFVs) accounting for 13 percent of the domestic passenger fleet and 11 percent of the commercial fleet by 2040, according to a new study from TTI’s Transportation Policy Research Center.

Alternative Fuel Technology adoption could affect long-term state fuel tax revenues with Alternative Fuel Vehicles (AFVs) accounting for 13 percent of the domestic passenger fleet and 11 percent of the commercial fleet by 2040, according to a new study from TTI’s Transportation Policy Research Center.

Associate Research Scientist Trey Baker and his team conducted an analysis of Alternative Fuel Vehicle Forecasts that explores trends in the AFV industry, factors impacting AFV adoption, and potential revenue impacts for the State Highway Fund from those trends.

Alternative Fuel Technology development trends involve five fuel sources: electricity; natural gas; ethanol; propane; and hydrogen fuel cells. Ethanol and compressed natural gas (CNG) are both taxed by the state at a per-gallon rate, but can be more fuel efficient, producing less revenue on a per-vehicle basis compared to their petroleum fuel-based counterparts. Electric vehicles basically operate for free on Texas roadways after sales and registration fees, meaning the state is unable to collect a “gas tax” from electric vehicle roadway consumers.

The primary barriers to AFV adoption are refueling infrastructure and cost to consumers. However, there are numerous state and federal incentives aimed at addressing these issues, particularly in the commercial sector. Most of these programs are oriented around reducing emissions and improving air quality by replacing older, more-polluting vehicles with more fuel-efficient, less-polluting ones. Alternative fuel vehicles tend to emit fewer pollutants than vehicles that run on traditional fuels while also tending to be more fuel efficient.

For more, go here.